defer capital gains tax canada

How do I avoid capital gains tax in Canada. You should lower the amount of capital gains tax on investments lasting 5 or 7 years when held for 10 and 15 years respectively.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The profit or loss is calculated from the value at the time your spouseparent purchased them not when they gave them to you.

. If you use all or more of the proceeds from selling the shares in your business to buy new qualifying investments you can defer 100 percent of your capital gains. If the reserve is claimed capital gains for a maximum of five years will be deferred. However sometimes you receive the amount over a number of years.

PUBLICLY TRADED OPPORTUNITY ZONES. 1990 the Inclusion Rate was increased again to 75. How Long Can I Defer Capital Gains Tax.

7 hours agoCan You Defer Capital Gains Tax In Canada. Comments for Deferal of capital gains tax in Canada. Besides helping you buy and sell real estate our Elevate team is happy to connect you with great accountants and are ready to grow with you.

B the total capital gain from the original sale. To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. Click here to learn more.

Canada does not have capital gains tax deferral rules like the US does 1031 exchange. Lifetime capital gain exemption. Bottom line isdespite their bad rapcapital gains can actually be the most tax-friendly of all investment returns and there are plenty.

As you can see capital gains taxes can vary depending on tax deferral choices appreciation rates your holding period and your overall income situation over time. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free. In this way you only owe taxes on the received earnings.

Claiming a capital gains reserve. For example you may sell a capital property for 50000 and receive 10000 when you sell it and the remaining 40000 over the next 4 years. One of the cleanest ways to save yourself from capital gains tax in Canada is to defer your earnings.

The Lifetime Capital Gains Exemption applies to some small business owners when they sell private qualifying shares. In Canada you only pay tax on 50 of any capital gains you realize. 1972 - it started with a 50 Inclusion Rate and all prior capital gains were exempted.

Capital gains tax will only have to be paid once you the new owner sells them. Please select Alaska Arizona Central Time US Canada Eastern Time US Canada Hawaii Indiana East Mountain Time US Canada Pacific Time US Canada. However if you use only a quarter of the proceeds of the disposition to make your new investment you only receive a deferral equal to a quarter of your capital gains.

If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. Schedule 3 must be filled out and filled out with your completed tax return for the year in which you claim the reserve form T 2017. The adjusted cost base ACB of the new investment is reduced by the capital gain deferred.

For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and the capital gains deferral on line 16100 of Schedule 3. The Canadian Chamber of Commerce recommends that the federal government. Capital gains can be claimed on a tax claim if your residence is in Canada.

Capital gains deferral B D E where. No you dont have to pay taxes on your capital gains if you sell your house for more than you bought it for as long as it was your primary residence. Available Date s Thursday March 10 2022.

To qualify both investments must be common shares of small business corporations. This deferral applies to dispositions where you use the proceeds to acquire another small business investment. An individual can invest in all of a company or associated group or a related corporation.

The corporations must be Canadian-controlled and must do most of their business in Canada. Choose Your Time Zone. D E or the total cost of all replacement shares whichever is less.

For example if you have a property worth 150000 and sell it for 200000 you can receive the amount yearly with over 50000 on profit. January 1 2022 is the 50th anniversary of the capital gains tax. 1988 - the Inclusion Rate was increased from 50 to 6667.

E the proceeds of disposition. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares.

A Brief History of the Capital Gains Tax in Canada. For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and the capital gains deferral on line 16100 of Schedule 3. One of the best ways to avoid or defer capital gains tax is by investing in a tax-sheltered account like an RRSP or TFSA.

Click here to add your own comments. These capital gains are available on qualified small business corporation shares held from 2021 through 2023. DEFER YOUR 2021 CAPITAL GAINS TAX.

No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. Without deferring the earnings youd owe approximately 24480 in taxes in the first year recognizing your earnings plus the full capital gain in. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021.

When you sell a capital property you usually receive full payment at that time. Capital gains deferral for investment in small business. This can reduce your income tax significantly.

If you sell qualifying small business corporation shares you can defer reporting your capital gains if you invest the proceeds of the sale into another eligible investment. Create a tax and regulatory environment that promotes the building of new affordable housing by allowing investors to defer CCA recapture and capital gains on the proceeds from the sale of rental property when the proceeds are reinvested in another rental property within a reasonable.

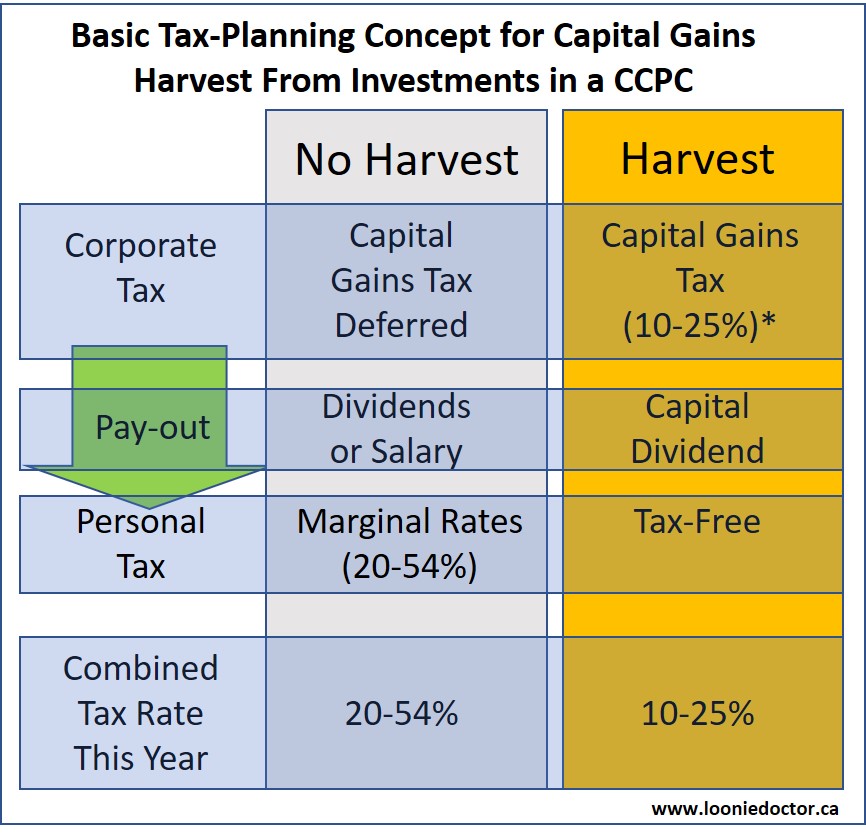

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Income Types Not Subject To Social Security Tax Earn More Efficiently

How Do I Report Capital Gains In British Columbia

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

Capital Gains Tax Calculator For Relative Value Investing

Long Term Capital Gains Tax Ltcg Vs Stcg Calculation Exemption 2022

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

5 Ways To Lower Capital Gains Tax On Sale Of Your Rental Property Cherry Chan Chartered Accountant Your Real Estate Accountant

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Calculator For Relative Value Investing

Long Term Capital Gains Tax Ltcg Vs Stcg Calculation Exemption 2022

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

Capital Gains Tax Japan Property Central

1031 Exchange Property For Sale Investing Property Listing Economic Analysis

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician