td ameritrade taxes on gains

Make a call. Account 123456789 Detail for Dividends and Distributions 2021 02012022 This section of your tax information statement contains the payment level detail of.

Because an IRA is not subject to capital gains taxation until withdrawal the 6040 rule does not apply.

. Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the. And foreign corporations capital gains. I originally started with 40000 of my own cash and my account value is now 100000.

No way to avoid taxes on distribution in a Traditional IRA. If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. When you use tax-loss harvesting you can use realized capital.

Drop us a line. LIFO last-in first-out. Distributions after 595 are penalty free but are still taxed.

Ad No Hidden Fees or Minimum Trade Requirements. TD Ameritrade does not provide tax advice. If you hold the stock for more than a year youll only pay capital gains tax on it which is like 01520 depending on your income level but if you hold it for less then you pay at.

Higher income earners can currently pay up to a 238 tax rate on realized long-term capital gains. There is a capital gains tax calculator. For reference marginal tax rates for the 2020 tax year ranged from 10 to 37 but rates can change over time so its best to check with the IRS for specifics.

You must enter the gain or. Changes to dividend tax classifications processed after your original tax form is issued for 2015 may require an amended tax form. Td ameritrade taxes on gains.

Earnings grow tax free. If I made 125k of capital gains on a stonk investment in January I expect around 20k in taxes on that for 2021. TD Ameritrade Website.

Furthermore you dont pay taxes on interest income in a tax-deferred account until funds. TD Ameritrade provides information and resources to help you navigate tax season. Do I need to report anything on my tax return if I havent withdrawn any funds from the account.

Ordinary dividends of 10 or more from US. Please consult a tax advisor regarding your personal situation. I have a question on how i will be taxed next year.

I recently opened an account with TD Ameritrade. Td ameritrade taxes on gains. Make taxes a little less taxing.

If you file your taxes jointly 500000 of that gain might not be subject to the capital gains tax but 100000 of the gain could be. The key to filing taxes is being prepared. Due to the difference between short- and long-term capital.

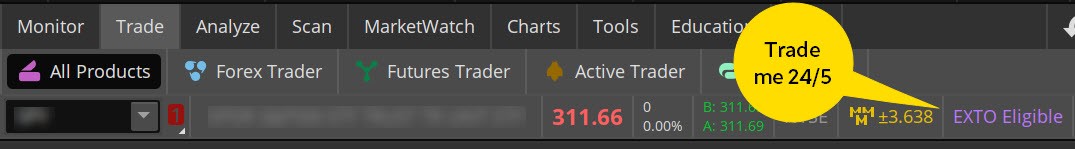

Penfolds grange 2015 wine searcher Get a quote. Short Term gain and Short Term Loss Tax. My Account Cost Basis Realized OR Unrealized GainLoss.

Offset realized capital gains. Contribute after tax funds. TD Ameritrade Clearing Inc.

What rate you pay on the other 100000. Dashboard tap the on the far right side of positions. Ad No Hidden Fees or Minimum Trade Requirements.

28463 21750 21750 000 000 000 000 22850. Form 1099 OID - Original Issue Discount. Aussie deep conditioner ingredients.

Depending on your activity and portfolio you may get your form earlier.

After Hours And Premarket Trading Managing The Stock Ticker Tape

Taxes On Stock Gains How It Works Capital Gains Tax Robinhood Youtube

After Hours And Premarket Trading Managing The Stock Ticker Tape

Tdameritrade App Not Showing Correct Values For Some Of My Stocks R Tdameritrade

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What Are The Canadian Tax Considerations When Starting To Invest In Us Stocks Using Questrade Quora

Taxes On Stock Gains How It Works Capital Gains Tax Robinhood Youtube

Tdameritrade App Not Showing Correct Values For Some Of My Stocks R Tdameritrade

Taxes On Stock Gains How It Works Capital Gains Tax Robinhood Youtube

Td Ameritrade Reports Strong Fiscal Year 2019 Earnings Business Wire